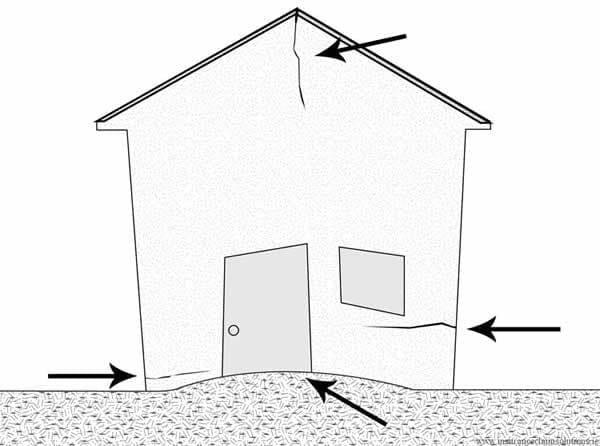

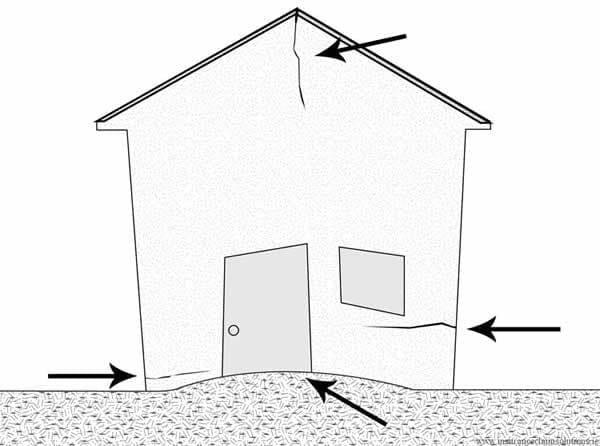

Subsidence Damage Case Study

Subsidence Damage Case Study Subsidence claims are very technical in nature and are generally difficult to prove. The policy wording usually includes lots of exclusions and there are many conditions which have to be met, before the claim is even considered. Cracking to buildings can be caused by many things, so unless you are a […]

Why Appoint A Loss Assessor to Handle your Insurance Claim?

A Public Loss Assessor represents you, the policy holder, not an insurance company. Insurance company profit is dependent on the amount of claims they receive and pay out. So, it is understandable that they are trying to limit the amount of claims they pay out. Each time you file a claim, they instruct their loss adjusters and the […]

Loss Assessor Guide to Handling Your Home Insurance Claim

Handling a home insurance claim by yourself can be tricky. You need to be able to interpret the small print and figure out whether any cover exclusions and clauses apply to your particular case. Then you need to be able to understand the full extend of the damage. Remember that some damage is not obvious […]

Insurance claims – Why is it so hard to get our money?

Advertising would have us believe that false insurance claims are the reason it’s so hard to get our money – but what’s the real picture? Read this article by CONOR POWER that appeared in The Irish Times on Monday, October 31, 2011 and find out.