Subsidence Damage Case Study

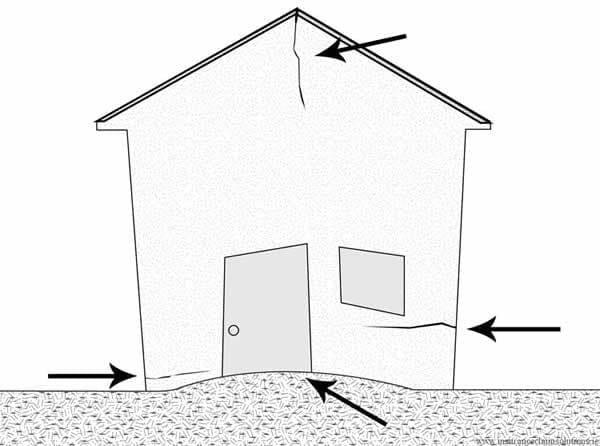

Subsidence claims are very technical in nature and are generally difficult to prove.

The policy wording usually includes lots of exclusions and there are many conditions which have to be met, before the claim is even considered.

Cracking to buildings can be caused by many things, so unless you are a structural engineer or you have substantial claim management knowledge, get some help, other wise your claim may be declined.

Below is a description of a subsidence claim we have recently managed.

ICS appointment came following a referral from a previous client. The property was a terraced 2 storey house in south Dublin built in the 1940’s. Earlier this year the owner became very concerned as a number of large cracks started to appear on the external and internal face of external walls.

Subsidence Claim – Action Taken

We arrived at the property within 24 hrs from the call and carried out a lengthy survey. We found that the 3 external walls had structural cracking, the windows and doors were difficult to close and the flooring was not level. We also noticed that the benching on the pipework in the main drain had broken. The missing/damaged benching on the pipework was allowing the water to escape straight into the ground causing the ground load bearing capacity to be compromised.

ICS reported the claim to insurers and they appointed a technical loss adjuster to attend site. We met with the loss adjuster and demonstrated the loss by showing where the water was escaping.

We then appointed a structural engineer to carry out a full structural survey, organise trial holes etc to further prove our case. The insurance company appointed their own engineer to look after the insurers interests.

ICS worked closely with both structural engineers to ensure that our client’s interests were protected. As a result we managed to prove that building was so extensively damaged that it required a full demolition and a new rebuild.

Lenghty negotiations with the insurance company loss adjuster followed, and as a result the client received a favourable settlement which allowed him to reinstate the property to current regulations and as new.

Subsidence Claims – The Value of Expert Advice

As we are not just insurance claim managers but also qualified building surveyors, we knew from our experience where to look. Areas, materials and surrounding rooms that initially don’t seem to be damaged, are often affected down the line. It is very important to establish/uncover these at the outset to ensure that you get your full compensation for your loss and don’t miss the hidden damage.

The advantages of employing a professional claims assessor.

The advantages of employing a professional claims assessor.

- No paperwork to fill out- ICS take care of this

- Access to our expert specialist partners to commence repairs without delay.

- Full claim management from start to finish from a registered building surveyor and regulated insurance expert.

- Peace of mind that no damage is left undiscovered

- Achieve more favourable settlement terms with considerably less stress

- Expert guidance, support and assistance in all areas of the claim an experienced professional building surveyor. Claims are our core business and we handle 100’s of claims every year.

- As ICS are owner operated the policyholder receives a 1 to 1 personal service.