When pipes burst in your home, the resulting water damage can be devastating both financially and emotionally. Understanding your burst pipe insurance claim options and how dedicated loss assessors can help navigate damage claims is crucial for every homeowner. This comprehensive guide explains the insurance claim process, reveals how to minimise losses, and demonstrates why professional loss assessors make the difference between a fair settlement and an inadequate payout. Whether you’re dealing with frozen pipes, leaking water, or sudden pipe damage, this article provides the essential knowledge to protect your property and maximise your home insurance coverage.

What Causes Pipes to Burst and How Can You Prevent Water Damage?

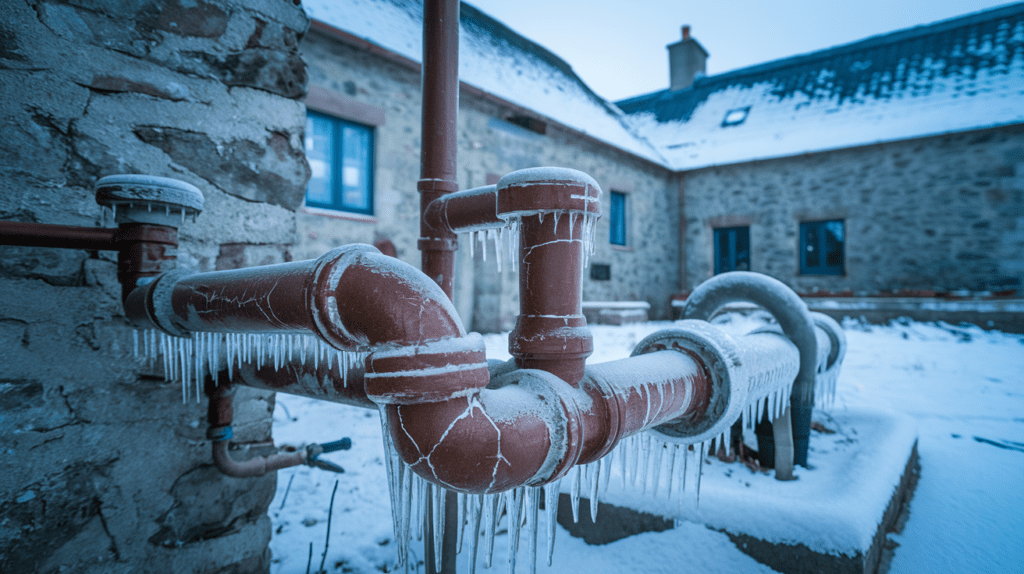

Understanding why pipes burst is fundamental to preventing catastrophic water damage in your home. The most common cause occurs when water in the pipe expands due to freezing temperatures, creating immense pressure that causes the pipe to crack or rupture completely. When water freezes, it can expand by up to 9%, and this expansion force is enough to burst even the strongest water pipes.

Frozen pipes are particularly problematic during winter months when temperatures drop suddenly. The pipe expands when frozen leading to structural failure, and once the ice thaws, water begins flowing through the damaged section. This creates the perfect storm for extensive water damage that can affect multiple areas of your property simultaneously.

Beyond freezing, pipes can also burst due to age-related deterioration, excessive water pressure, or physical damage from construction work. Older homes with galvanised steel pipes are especially vulnerable, as these materials become brittle over time and are likely to fail without warning. Regular maintenance and pipe inspections can help identify potential problems before they result in costly insurance claims.

How Does Home Insurance Cover Burst Pipe Damage Claims?

Most standard home insurance policies provide coverage for sudden and accidental water damage caused by burst pipes, but understanding the specifics of your coverage is essential. Your building insurance typically covers structural damage to walls, floors, and ceilings, while contents insurance protects your personal belongings damaged by the water leak.

However, insurance policies often exclude damage caused by gradual leaks or poor maintenance. The insurance company will investigate whether the pipe burst was sudden and unexpected, or if it resulted from negligence or lack of proper maintenance. This distinction can significantly impact whether your claim is approved and the settlement amount you receive.

It’s important to note that while your insurer may arrange for a loss adjuster to assess the damage, this professional works for the insurance company, not for you. Their role is to minimise the insurer’s liability, which is why many homeowners benefit from hiring their own dedicated loss assessor to ensure they receive a fair settlement that covers the full extent of the damage.

What Steps Should You Take Immediately After a Pipe Bursts?

The first critical step when dealing with a burst pipe is to turn off the water supply immediately to stop the flow of water and prevent further damage. Locate your main water shut-off valve and turn it off, then contact a qualified plumber to assess and repair the damaged pipe. Time is crucial in these situations, as every minute of delay can result in additional water damage.

Document everything thoroughly by taking photographs and videos of the damage before any cleanup begins. This visual evidence will be invaluable when you make an insurance claim, as it provides clear proof of the extent of the damage and the conditions immediately following the incident. Photograph water-damaged items, structural damage, and any obvious water damage – water can seep into areas that might not be immediately visible.

Contact your insurance company as soon as possible to report the claim, but remember that their primary concern is protecting their own interests, not maximising your settlement. Consider contacting experienced loss assessors who can help you navigate the claims process and ensure you receive the full compensation you’re entitled to under your policy.

Why Do You Need a Loss Assessor for Your Burst Pipe Insurance Claim?

A dedicated loss assessor serves as your advocate throughout the insurance claim process, working exclusively in your best interests during what can be a stressful time. Unlike loss adjusters who work for insurance companies, loss assessors represent policyholders and have extensive experience dealing with water damage claims and burst pipe scenarios.

Professional loss assessors understand the complex language of insurance policies and can identify coverage that you might otherwise miss. They know how to properly document damage, compile comprehensive claims, and present evidence in a way that maximises your settlement. Their expertise becomes particularly valuable when dealing with hidden damage that might not be immediately apparent, such as water that has seeped along joists or into wall cavities.

Insurance companies often attempt to settle claims quickly and for amounts lower than what policyholders are truly entitled to receive. A skilled loss assessor will negotiate the best settlement on your behalf, ensuring that all damage is properly assessed and compensated. This professional representation can mean the difference between receiving a fair settlement and being significantly undercompensated for your losses. Learn more about how much a loss assessor costs and who pays for their services.

How Does the Insurance Claim Process Work for Water Damage?

The insurance claim process begins when you notify your insurance company of the burst pipe incident. Your insurer will typically assign a loss adjuster to conduct an initial assessment of the damage and determine the validity of your claim. However, remember that this individual works for the insurance company and their goal is to minimise the claim amount.

During the assessment phase, the loss adjuster will examine the damaged areas, review your policy coverage, and prepare a report for the insurance company. This process can take several weeks, and the adjuster’s conclusions will significantly impact your final settlement amount. Having your own loss assessor present during these assessments ensures that all damage is properly identified and documented. Understanding what a loss adjuster does versus what an insurance assessor does can help you better navigate this process.

The claims process involves multiple stages including damage assessment, repair estimates, coverage verification, and settlement negotiation. Each stage presents opportunities for insurance companies to reduce claim amounts or deny coverage entirely. Professional loss assessors help you navigate these challenges and ensure that your claim receives the attention and compensation it deserves. Learn how to speed up the insurance claim process with proper preparation and representation.

What Types of Water Damage Claims Are Most Common from Burst Pipes?

Burst pipe water damage can affect numerous areas of your property, and the extent of the damage often extends far beyond what’s immediately visible. Structural damage to walls, floors, and the ceiling represents the most obvious impact, but water can seep into hidden areas causing long-term problems that might not manifest for weeks or months after the initial incident.

Content damage represents another significant category of water damage claims. Personal belongings, furniture, electronics, and important documents can all be destroyed or severely damaged when pipes burst. The value of these items can quickly accumulate to substantial amounts, making thorough documentation essential for proper compensation.

Secondary damage such as mold growth, wood rot, and electrical system damage often develops after the initial water intrusion. These issues can make your home uninhabitable due to health concerns and safety hazards. Professional loss assessors understand how to identify and document these secondary damages to ensure they’re included in your claim settlement. For comprehensive guidance, read our article on dealing with insurance adjusters after water damage.

How Can You Minimise Damage and Strengthen Your Insurance Claim?

Acting quickly to minimise water damage demonstrates responsible homeowner behavior and can strengthen your insurance claim significantly. After turning off the water supply and contacting emergency services, begin removing water and moisture from affected areas as quickly as possible. Use pumps, wet vacuums, and dehumidifiers to extract standing water and reduce humidity levels.

Remove damaged materials and belongings from the affected area to prevent further deterioration and mold growth. However, don’t dispose of anything until your loss assessor has had the opportunity to document and photograph all damaged items. This evidence is crucial for supporting your claim and ensuring proper compensation for your losses.

Keep detailed records of all expenses related to the burst pipe incident, including emergency repairs, temporary accommodation costs, and professional cleaning services. These expenses are often covered under your policy’s additional living expenses provision, but proper documentation is essential for reimbursement. Your loss assessor can help identify all covered expenses and ensure they’re included in your claim.

What Role Do Loss Adjusters Play in the Claims Process?

Loss adjusters are professionals hired by insurance companies to investigate and evaluate insurance claims on their behalf. When you report a burst pipe claim, your insurer may arrange for a loss adjuster to visit your property and assess the damage. While these professionals are knowledgeable about insurance matters, it’s important to remember that they work for the insurance company, not for you.

The loss adjuster will provide a report to your insurance company detailing their findings and recommendations for settlement. This report carries significant weight in determining your final compensation amount, which is why having your own representation during this process is so valuable.

Understanding why insurers appoint loss adjusters and whether loss adjusters are regulated in Ireland helps you better understand their role in the process. Professional loss adjusters can provide valuable expertise in evaluating damage and determining repair costs, but their primary loyalty lies with the insurer who hired them. This inherent conflict of interest makes it essential for policyholders to have their own advocate in the form of a dedicated loss assessor who works exclusively in their interests.

How Do Frozen Pipes Lead to Burst Pipe Insurance Claims?

Frozen pipe damage represents one of the most common causes of winter water damage claims, particularly in Ireland where sudden temperature drops can catch homeowners unprepared. When temperatures fall below freezing, water pipes in unheated areas such as attics, basements, or exterior walls are most vulnerable to freezing.

The freezing process begins when the water temperature drops to 0°C, causing the water to crystallise and expand. This expansion creates tremendous pressure within the pipe, often exceeding the material’s structural limits. The pipe may crack immediately or develop stress fractures that fail when the ice thaws and water pressure increases.

Prevention involves insulating water pipes in vulnerable areas, maintaining consistent heating throughout your home, and allowing faucets to drip during extreme cold spells. However, when prevention fails and frozen leading to pipe failure occurs, having proper insurance coverage and professional representation becomes essential for recovery. Understanding that frozen pipe damage is typically covered under standard home insurance policies helps homeowners feel more confident about seeking full compensation for their losses.

What Should You Expect During the Damage Assessment Process?

The damage assessment process typically begins within 24-48 hours of reporting your burst pipe claim to your insurance company. An initial assessment will focus on immediate safety concerns and the scope of visible damage, but comprehensive evaluation often requires multiple visits and specialised equipment to detect hidden moisture and structural damage.

Professional assessors use moisture meters, thermal imaging cameras, and other specialised tools to identify water damage that might not be immediately visible. Water can seep along joists, into wall cavities, and beneath flooring materials, creating damage that may not become apparent until days or weeks after the initial incident. Thorough assessment is crucial for ensuring that all damage is properly documented and included in your claim.

The assessment process should include evaluation of both structural damage and contents losses. Your assessor should examine the ceiling, walls, flooring, and any affected personal belongings. Apart from the obvious water damage, look for signs of secondary damage such as warping, discoloration, or musty odors that might indicate developing mold problems. A comprehensive assessment forms the foundation of a successful insurance claim.

How Can Loss Assessors Ireland Help Negotiate the Best Settlement?

Loss assessors Ireland are regulated by the Central Bank of Ireland and must maintain professional standards that ensure they act in their clients’ best interests. These professionals have dealt with all types of water damage claims and understand the specific challenges that Irish homeowners face when dealing with burst pipes and insurance companies.

When you hire a dedicated loss assessor, they take over all communication with your insurance company and handle every aspect of your claim from start to finish. This relieves you of the stress and complexity of dealing with insurance professionals while ensuring that your claim receives expert attention. They help you compile comprehensive documentation, negotiate with insurance representatives, and fight for the maximum settlement allowed under your policy.

The investment in professional loss assessor services typically pays for itself through increased settlement amounts and reduced stress during an already difficult time. These professionals understand insurance law, policy language, and claims procedures in ways that most homeowners cannot match. Their expertise helps ensure that you receive the full compensation you’re entitled to under your policy, making the difference between adequate recovery and financial hardship.

Key Points to Remember

- Act immediately when pipes burst by turning off the water supply and contacting emergency services to minimise damage and strengthen your insurance claim

- Document everything thoroughly with photographs and videos before beginning cleanup, as this evidence is crucial for supporting your claim

- Understand your coverage by reviewing your home insurance policy to know what damage is covered and what exclusions might apply

- Consider hiring a loss assessor to represent your interests and ensure you receive fair compensation rather than relying solely on the insurance company’s adjuster

- Be aware of hidden damage as water can seep along joists and into wall cavities, causing problems that may not be immediately visible

- Keep detailed records of all expenses related to the incident, including emergency repairs, temporary accommodation, and professional services

- Prevent future incidents by insulating pipes in vulnerable areas and maintaining consistent heating during cold weather

- Know the difference between loss adjusters (who work for insurance companies) and loss assessors (who work for policyholders)

- Don’t accept the first settlement offer without professional evaluation, as initial offers are often lower than what you’re entitled to receive

- Understand the claims process timeline and your rights as a policyholder to ensure you receive proper treatment throughout the process