When disaster strikes your home or property, the initial shock is quickly followed by a daunting reality: the insurance claim. Suddenly, you’re faced with a mountain of paperwork, confusing jargon, and the pressure of dealing with your insurer’s appointed loss adjuster. It’s a stressful, often overwhelming situation where it’s easy to feel out of your depth. But you don’t have to go through it alone.

A loss assessor is a professional advocate who works exclusively for you, the claimant. They are not the same as the adjuster sent by your insurer. Their sole purpose is to manage your entire claim and fight for your best interests. The most common question policyholders ask is, “How much does this help cost?” Understanding the loss assessor fees is the key to unlocking the support you need to rebuild.

What is the Typical Cost of a Loss Assessor in 2025?

So, how much does a loss assessor really cost you? In Ireland, the established fee structure is designed to be a direct investment in the success of your claim. Reputable loss assessors work on a percentage-based fee, typically ranging from 5% to 10% of the final insurance settlement they negotiate on your behalf. This fee will also have VAT added, so be sure to clarify this from the outset.

Crucially, most leading firms operate on a ‘No Win, No Fee’ basis. This is a powerful assurance for you as the policyholder. It means if they don’t succeed in securing you a settlement, you owe them absolutely nothing. This model removes the financial risk from your shoulders and demonstrates the assessor’s confidence in their ability to deliver results. The loss assessor cost isn’t an upfront expense but a fee deducted from the money they secure for you, ensuring their goals are perfectly aligned with yours: to maximise your payout. The costs involved are justified by the significant value they add, often increasing the settlement by far more than the cost of their fee.

Why a Loss Assessor is Your Most Valuable Ally in a Claim

Hiring an experienced loss assessor is about levelling the playing field. The loss adjuster works for the insurance company; your loss assessor works for you. When you appoint an assessor, you are engaging a specialist whose expertise can dramatically alter the outcome of your home insurance claim.

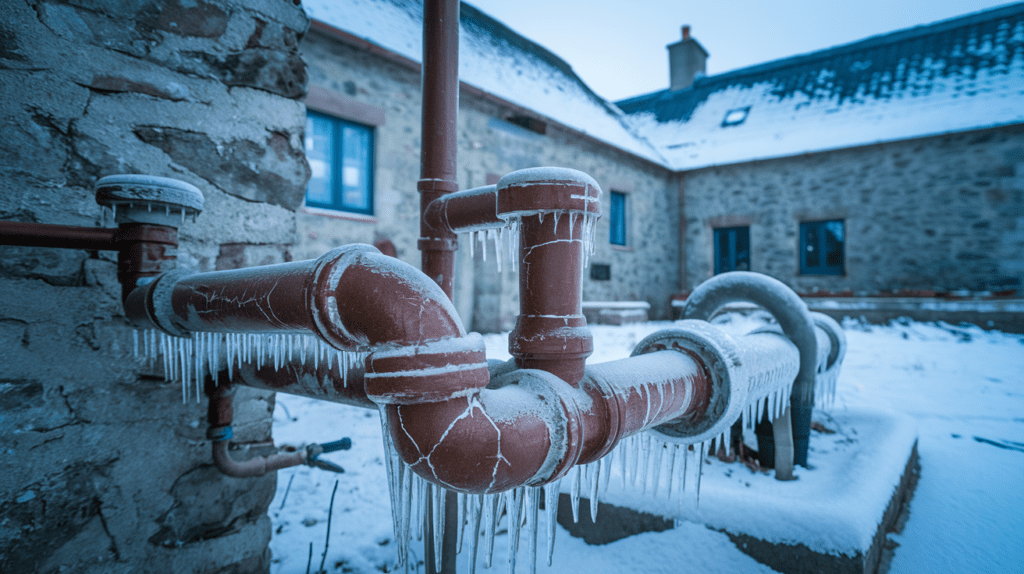

Their value goes far beyond simply filling out forms. They conduct a thorough assessment of your property damage, uncovering hidden issues that are often missed, such as after a burst pipe insurance claim or long-term structural issues after a flood. They meticulously catalogue every loss and understand how to properly cost repairs and replacements at current market rates. Furthermore, they are expert negotiators who speak the same language as the insurance company. They can skillfully argue your case, handle all communications, and manage the entire claim handling process, often helping to speed up your insurance claim. This frees you from the stress and anxiety of dealing with insurers so you can focus on what matters most.

The Critical Difference: Understanding Loss Assessor vs. Loss Adjuster

Confusing these two roles is a common and costly mistake. They represent opposite sides of the negotiation table.

A Loss Assessor, often called a Public Loss Assessor, is an independent professional hired by you. They are your representative, your advocate, and your strategist. Their duty is to you and you alone, with the objective of ensuring you receive the maximum payout you are entitled to under your policy.

A Loss Adjuster, on the other hand, is appointed and paid by the insurance company. While they are bound by professional ethics, their primary role is to investigate the claim for their employer. They represent the insurance company’s interests by assessing the validity and value of the claim from the insurer’s perspective. Think of it this way: the adjuster works to ensure a fair outcome for the insurer, while your assessor works to secure the best outcome for you.

How are Loss Assessor Fees Paid?

This leads directly to another common query: who pays for a loss assessor? You, the policyholder, are responsible for the loss assessor fees. However, this payment is not typically an out-of-pocket expense. The standard practice is for the fee to be deducted directly from the settlement cheque issued by the insurer.

This arrangement is fundamental to the value proposition. A good assessor’s work should result in a significantly higher claim amount. For example, if an insurer’s initial offer on major water damage is €30,000, an assessor might successfully renegotiate it to €50,000. Their 10% fee (€5,000 + VAT) would be deducted from that higher amount, leaving you with substantially more money to complete repairs than if you had accepted the first offer. This is why their service is considered an investment, not just a cost.

When Is it Crucial to Appoint a Loss Assessor?

While helpful in any claim, their value becomes indispensable in certain situations. If you find yourself asking “do I need a loss assessor?” the answer is almost certainly yes when you are facing complex claims or significant financial stakes. This includes major events like a house fire with resulting smoke damage, widespread flooding, or severe storm damage.

If you feel overwhelmed by the complexity of the claim process or simply don’t have the time or expertise to manage it, an assessor is essential. You should also appoint one immediately if you receive a settlement offer that seems unfairly low or if the insurer is disputing parts of your claim, such as in cases involving malicious damage to property. The best time to get an assessor involved is right at the beginning, as it allows them to control the narrative and manage the claim professionally from day one.

Finding Reputable Loss Assessors in Dublin and Ireland

Whether you need loss assessors in Dublin to handle an apartment fire or are dealing with a claim elsewhere in the country, it’s vital to choose a firm with a proven track record. The first thing to check is that they are regulated by the Central Bank of Ireland. This is a non-negotiable mark of professionalism and accountability.

Look for a firm that specialises in property insurance claims and has clear, transparent fees. Don’t hesitate to ask for testimonials or case studies. A reputable assessor will be a clear communicator who can provide you with complete insurance claim management and guide you toward the settlement you deserve. By making this one smart decision, you are not just hiring a negotiator; you are securing a partner to navigate you through a difficult time and ensure your financial recovery is complete.