A loss adjuster is an independent claims specialist appointed by insurance companies to investigate and assess insurance claims. They play a key role in the claims process by conducting a thorough assessment of damages and losses to determine fair settlement amounts. This article will explain what loss adjusters do, why insurers use them and provide useful tips for policyholders going through the claims process.

Table of Contents

Why Insurers Appoint Loss Adjusters

Insurance companies utilise loss adjusters because they have specialised expertise, experience and impartiality when assessing claims. As independent third parties, loss adjusters can evaluate claims thoroughly and accurately to derive fair settlements. They also take on the administrative workload of investigating claims, allowing insurers to focus resources elsewhere. With their extensive knowledge, loss adjusters help ensure claims are settled promptly and policyholders receive the correct insurance compensation.

What Does a Loss Adjuster Do?

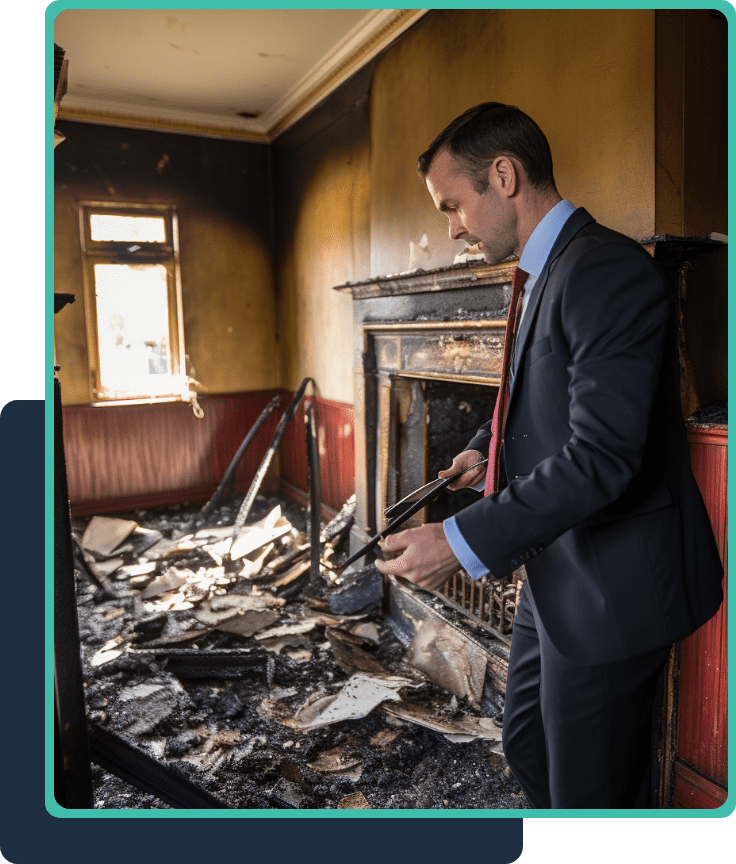

When you make an insurance claim, the loss adjuster takes on an investigative role to establish the circumstances and validity of the loss. They will inspect your property damage, review documentation and photographs, and consult technical reports such as police or fire department findings. The loss adjuster determines the scope of damage and appropriate repairs needed, obtaining contractor quotes if necessary. They will then compile a detailed claims report for the insurer outlining their assessment of the loss, recommended claim settlement, and repair requirements.

The Claims Assessment Process

If a loss adjuster is visiting your property, you can expect a thorough inspection and investigation into the damage or loss. They will ask you questions about what happened and assess things like fire/water damage, theft, or business interruption impacts. The loss adjuster gathers evidence such as photographs and documents to determine the claim value and how much the insurer should pay out based on your coverage. It is in your interest to cooperate fully with the inspection and provide any evidence to validate your claim.

Why do insurers appoint Loss Adjusters?

A key responsibility of loss adjusters is to handle claims impartially so policyholders receive fair settlements. Though appointed by insurers, they remain fully independent when assessing the appropriate claim amount under policy terms. Loss adjusters will consider factors like the extent of damages, repair costs, policy limits, and causation to determine the value of a claim. They are experienced experts at investigating insurance losses and have a professional duty to handle claims ethically.

Claims Tips for Policyholders

If your claim involves a loss adjuster visit, prepare by having all relevant documentation, photographs, receipts or reports ready. Make time to walk through your property with the adjuster and answer their questions honestly. Cooperate fully with their inspection but don’t volunteer unnecessary information. Review the adjuster’s report when received and query any concerns. If you disagree with their claim settlement or calculations, discuss this politely with your insurer and loss adjuster first. However, you can appoint your loss assessor for an independent review if required.

Who appoints a loss adjuster?

A loss adjuster is appointed and works on behalf of the insurance company.

What should you not say to a loss adjuster?

While it may be natural to feel remorseful about the situation, refrain from apologising or accepting blame for the incident.

Is the loss adjuster the same as the surveyor?

If your fire, flood, storm or subsidence claim is accepted by the loss adjuster the loss adjuster will usually appoint one of their in-house surveyors to manage the repairs.

Are Loss Adjusters impartial?

Although Loss Adjusters are meant to be impartial, they are still paid and selected by insurance companies. For peace of mind always commission a loss assessor to ensure you get the most appropriate settlement.