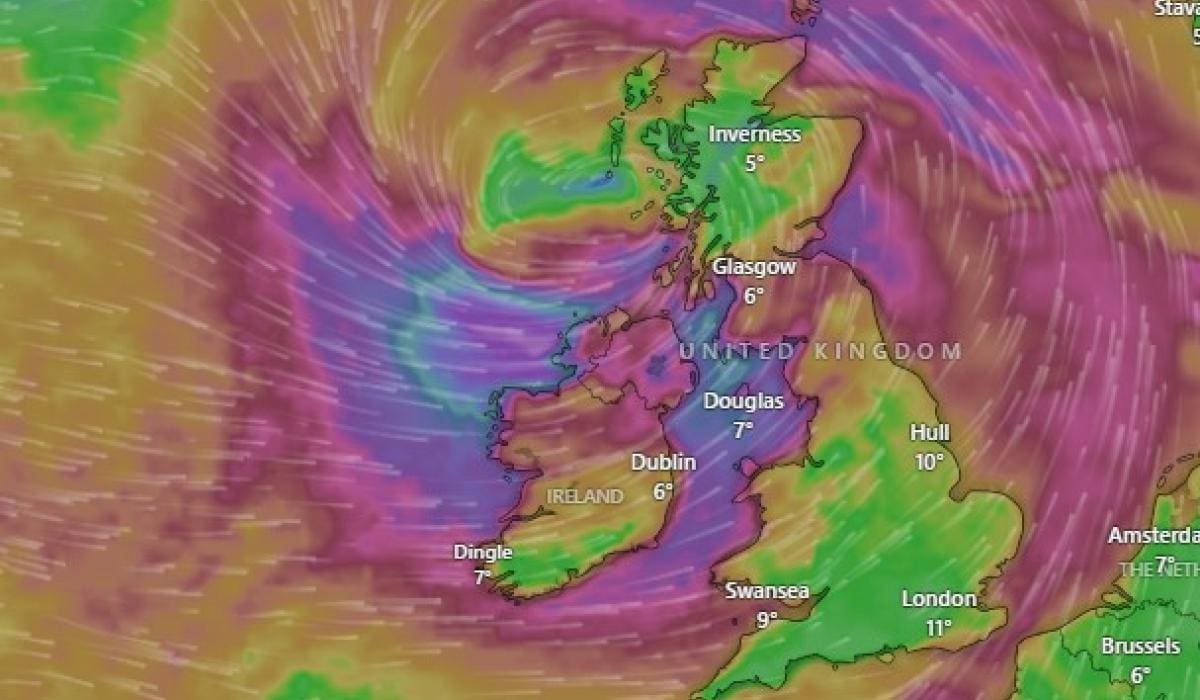

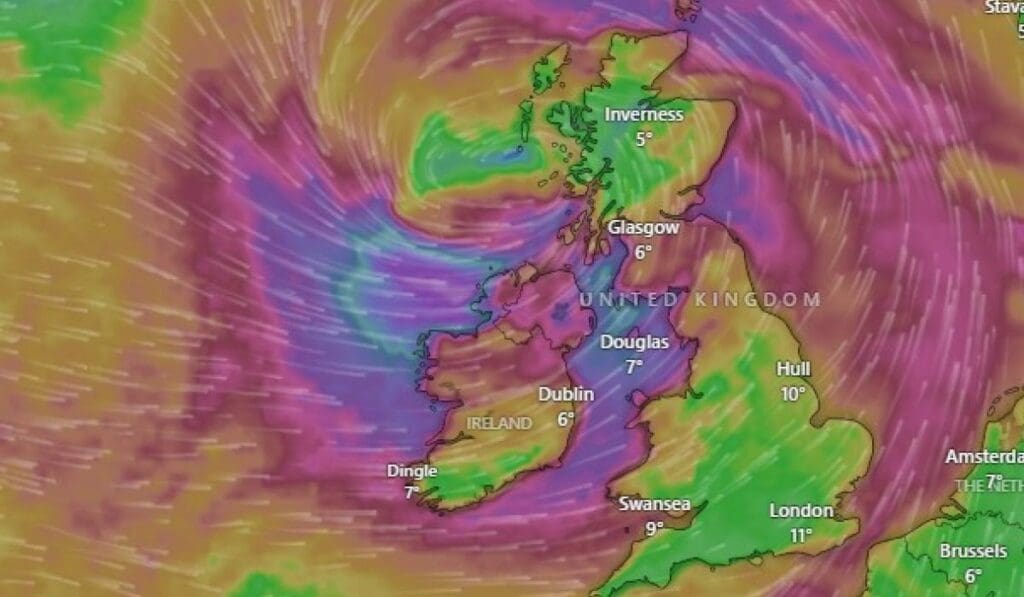

Hello, I’m Trevor Kelly, Managing Director of Insurance Claim Solutions and Rebuildvaluation.ie. As Ireland’s leading loss assessors, we understand the significant impact that severe storms can have on homeowners. With over 20 years of experience as a Chartered Surveyor, I’ve seen firsthand how devastating these events can be. Recent storms like Storm Éowyn (expected to make landfall on Friday, January 24, 2025) and the severe weather that has battered our country in recent years, highlight the importance of having robust home insurance coverage.

During red weather warnings, such as those expected with Storm Éowyn, the National Emergency Co-ordination Group advises against all non-essential travel for your safety. So, can you claim on your home insurance for storm damage here in Ireland? The answer is generally yes, but the specifics can be complex. Let’s break down what you need to know.

Table of Contents

Understanding Storm Damage Insurance Cover in Ireland

The good news is, most standard Irish home insurance policies include coverage for storm damage. This typically covers damage caused by wind, rain, and even flooding directly related to a storm event. It’s not just about everyday bad weather; it’s about damage caused by severe and specific storms.

What’s Usually Covered Under an Irish Home Insurance Policy?

In Ireland, a standard home insurance policy will generally cover:

- Damage from falling trees, branches, aerials, masts, and satellite dishes.

- Water damage from wind-driven rain.

- Structural damage caused by high winds.

- Temporary repairs to prevent further damage.

- Alternative accommodation if your home is uninhabitable.

- Costs to find the source of water leaks.

Common Exclusions – What’s Not Always Covered:

However, not all storm-related damage is automatically covered. Here are some of the common exclusions you’ll find in Irish policies:

- Outbuildings: Damage to fences, garden sheds, gates, and hedges are often not covered unless specifically included in your policy.

- Wear and Tear: Gradual damage from wear and tear, like a leaking roof due to age, is usually excluded.

- Faulty Workmanship: Damage from poor workmanship or defective materials is typically not covered.

- Business Property: Damage to property used for business, is usually excluded unless there was forced entry.

- Vehicles: Damage to cars is usually covered by comprehensive motor insurance, not home insurance.

- Excess: Any claim below your policy excess will not be covered.

- Flood Damage: Standard policies often exclude flooding from rising groundwater or rivers. Separate flood insurance is required in high-risk areas.

- Subsidence: Damage from ground movement (subsidence) is typically excluded unless explicitly added to your policy. Homeowners in areas with clay soils or mining activity should consider this coverage.

- Items Outside: Any item that is outside the house, not explicitly listed in your policy may not be covered.

It is crucial to thoroughly review your policy, understand these exclusions, and consider adding extra coverage if required.

The Financial Impact: Average Claim Amounts

Recent data shows that the average storm damage claim in Ireland is approximately €3,851 for contents insurance and €3,590 for buildings insurance. This highlights the considerable financial impact a severe storm can have and underscores the importance of having adequate insurance. As a result, it is critical that your home insurance is up-to-date, and not underinsured. You can learn more about the risks of underinsurance here.

Types of Storm Damage Covered

Let’s look at specific types of damage commonly covered by Irish home insurance:

- Wind Damage: Strong winds can cause significant structural damage, such as roof damage, broken windows, and other serious structural problems. Strong winds also have the ability to force rain inside via cracks and crevices, or to break falling items that cause damage.

- Rain Damage: Heavy rainfall, especially combined with strong winds, can cause water leaks, dampness, and potential structural weakening to your home. It is important that your roof is kept well-maintained. For more information about water damage and insurance claims check out our guide on water damage.

- Flood Damage: If your home is damaged by flooding caused directly by a storm (such as rainwater entering the building due to a storm), your insurance policy should cover the necessary repairs. However, standard policies often exclude flood damage resulting from rising groundwater or rivers, requiring separate flood insurance if you are in a high-risk area. See more information about flood damage claims here.

- Damage from Falling Objects: Damage caused by falling trees, branches, or other debris is generally covered under most standard home insurance policies in Ireland. If you have suffered from a fallen tree, read our article on can i claim on insurance for a fallen tree.

- Roof Damage from High Winds or Hail: Severe weather conditions such as high winds or hailstorms can cause significant damage to your roof. Shingles may be torn off, tiles cracked, or structural damage may occur, leaving your home vulnerable to further harm.

- Broken Windows or Doors from Flying Debris: Flying debris, propelled by strong winds, can shatter windows or break doors. These breaches compromise your home’s security and can lead to additional damage from wind and rain entering the property.

- Water Damage from Heavy Rainfall: Heavy rainfall can lead to water damage within your home, excluding damage caused by rising groundwater or flooding. This type of damage may impact walls, ceilings, and belongings, especially if your home’s drainage or roofing systems are compromised.

- Fire Damage from Lightning Strikes: Lightning strikes during storms can ignite fires, causing severe damage to your home and possessions. Ensuring your property has adequate lightning protection can help mitigate this risk.

Many policies will also cover the cost of emergency repairs, alternative accommodation if your home becomes uninhabitable, and expenses to find the source of water leaks.

What Does Storm Damage Coverage Typically Include:

Your home insurance policy typically includes:

- Coverage for Repairs to Structural Components: Your home insurance policy typically covers repairs to essential structural elements, including roofs, walls, and windows, damaged by a storm.

- Replacement or Repair of Damaged Personal Belongings: Storm damage coverage often extends to personal belongings inside your home, such as furniture, electronics, and clothing.

- Costs for Temporary Accommodation: If storm damage makes your home uninhabitable, your policy may cover the costs of temporary accommodation. This can include hotel stays or rental expenses while repairs are completed.

Making a Storm Damage Claim: A Step-by-Step Guide

If your property has been damaged by a storm, acting quickly and effectively is critical. Here’s what you should do:

Immediate Actions:

- Ensure Safety First: Make sure you and everyone around you is safe. Check for hazards such as downed power lines or unstable structures.

- Document the Damage: Take clear photos and videos of all affected areas immediately once it is safe. This will help to demonstrate the extent of the damage. Include close-ups and wider shots to provide context.

- Make Temporary Repairs: Do what you can to prevent further damage, such as covering broken windows or placing tarps over damaged roofs. This demonstrates that you have taken action to protect your property.

The Claims Process in Ireland:

- Report the Damage: Contact your insurance provider as soon as possible. You will find the contact details in your policy documents. Early notification ensures your claim is processed as quickly as possible and minimizes delays in addressing the damage.

- Complete Claim Forms: Your insurer will provide you with claim forms, be as thorough as possible and give as much detail as you can. Fill out all required claim forms thoroughly and accurately to avoid delays or potential denials. Double-check your information to ensure it aligns with the evidence provided and meets your insurer’s requirements.

- Assessment: Your insurer may send their own assessor to assess the damage. They will have a process that they need to follow.

- Settlement: If your claim is approved, your insurer will process the settlement according to the terms of your policy.

- Repairs: Once the claim is approved and you have reached an agreement, you can begin to make repairs. It is always best to use professionals. For more information on the claims process, see our page on how to claim on home insurance.

What to Expect From Your Insurer:

Your insurance provider will review your policy and assess the damage to determine what the policy covers. This can often be a slow process, and insurers don’t always have your best interests at heart. If you are in doubt, contact a loss assessor to help.

Dealing with Claim Denials:

If your claim is denied, the first step is to understand why. You can then get a loss assessor to look into the reasons behind the denial. It may be that an assessment is flawed, or that the policy does not cover what you have claimed for.

Reasons Why Storm Damage Claims May Be Denied:

- Pre-Existing Issues: If your property has not been properly maintained and issues like a pre-existing roof leak are present, your storm damage claim may be denied. Insurers often exclude coverage for damage resulting from neglect or a lack of routine upkeep. Claims are only honoured if your home has been “suitably maintained” (e.g., clearing gutters before the storm)

- Negligence: Insurance claims may be denied if damage is deemed to result from negligence, such as leaving windows or doors open during a storm. Insurers expect homeowners to take reasonable precautions to minimise potential risks.

- Misunderstanding Policy Exclusions: Storm damage claims may be rejected if policy exclusions are misinterpreted. For example, some policies differentiate between flooding and rainwater damage. Claiming for an excluded event, such as rising groundwater, could lead to a denial.

The Problem of Underinsurance and the Average Clause:

A key issue we see here in Ireland is underinsurance. If the declared value of your home on your insurance policy doesn’t reflect the actual cost to rebuild, you may not be fully covered in the event of significant damage. Furthermore, the Average Clause may apply, reducing your payout proportionally. For instance, if your home would cost €200,000 to rebuild, but you have it insured for only €100,000, your settlement will be reduced by 50%. At Rebuildvaluation.ie, we specialize in providing accurate building insurance valuations so that you are protected from this common issue.

Preventative Measures to Safeguard Your Home

While insurance is essential, prevention is always better. Here are some measures to help protect your home before a storm:

Before the Storm:

- Keep Emergency Phone Numbers Accessible: Have emergency phone numbers at hand to act swiftly in critical situations.

- Charge Your Mobile Phone Fully: Maintain a reliable backup communication tool by fully charging your mobile phone.

- Secure Your Home: Protect your property by locking all gates and securely closing windows.

- Protect Critical Documents: Place important documents in a secure, elevated location to shield them from potential damage.

- Secure Loose Outdoor Items: Bring garden furniture, tools, and other loose items indoors or anchor them securely.

- Regular Maintenance: Check your roof, gutters, and windows regularly, repairing any signs of wear or damage.

- Check Roof Tiles and Drainage Systems: Before a storm, ensure that your roof tiles are secure and that your drainage systems are clear to prevent blockages.

- Trim Trees: Trim any tree branches that could fall on your property during a storm.

- Lightning Protection: In areas that are prone to lightning strikes, install a lightning protection system. You can also read more on our blog post regarding lightning damage.

- Flood Preparation: If you live in a flood-prone area, use flood barriers and other measures.

- Review Your Insurance: Make sure your policy is always kept up to date, as the cost of repairs changes regularly.

- Check if a Flood Warning Has Been Issued: Use resources like flood maps and alerts to assess your risk and plan accordingly.

During the Storm:

- Stay safe inside your house

- Take measures to protect your property if it is safe to do so, while always making safety your top priority.

Power Outages:

Storms often bring widespread power cuts, so it is useful to have your insurer’s contact information readily available, and make sure you have back-up power for your phones.

The Value of a Loss Assessor

Navigating an insurance claim can be stressful, complex, and time-consuming. This is where a loss assessor can be invaluable.

How a Loss Assessor Helps You

Unlike the insurance company’s assessor who works for them, a loss assessor works for you, the homeowner. We are your advocate, acting on your behalf to ensure you receive the best possible outcome. We handle:

- Assessing the full extent of the damage.

- Preparing and submitting your claim.

- Negotiating with the insurer.

- Ensuring all claim forms are completed correctly.

- Providing expert advice and support.

- Getting you the maximum settlement available to you.

- Making sure the full cost to repair is covered by your insurer.

To understand more about what a loss assessor does, you can check out our article What is a loss assessor and why you need one. Also, learn how a loss assessor can help with your claim on our page how loss assessors help with insurance claims.

Why Choose Insurance Claim Solutions?

As Managing Director of Insurance Claim Solutions, I, Trevor Kelly, am a leading loss assessor in Ireland, with over 20 years of industry experience. We have a proven track record of successfully handling thousands of claims. We are fully accredited Building Surveyors, registered as Public Loss Assessors Reg. No: C423441 and regulated by the Central Bank of Ireland. Our commitment is to secure the best possible results for our clients. We are not an insurance provider; we work for you. You can read more about our services here.

Real-World Example:

Recently, following a particularly bad storm, we assisted a homeowner who had substantial damage to their roof and internal water damage. The insurer’s initial settlement offer was significantly lower than the cost to repair. We negotiated with the insurer and managed to achieve a settlement that covered the full repair costs, avoiding a lot of stress for our client.

Irish Regulatory Context

It is important to note that insurance companies in Ireland are regulated by the Central Bank of Ireland, which provides guidance and regulations that insurers must comply with. You are also protected by the Consumer Insurance Contracts Act 2019. It is important that you are fully aware of your rights. If you disagree with your insurer’s assessment, you can escalate the issue through your insurer’s complaints process or seek mediation through the Financial Services and Pensions Ombudsman.

Conclusion

Storm damage can be devastating, but being informed and prepared can make a difference. Understanding your home insurance policy, documenting damage, and avoiding common pitfalls can help you navigate the claims process with confidence. It is always a good idea to take preventative measures and secure your property. If you are unsure, contact a loss assessor and make sure you get the best result from your insurance claim. At Insurance Claim Solutions, we are dedicated to ensuring you get a fair settlement and that your home is repaired fully. Contact Insurance Claim Solutions for a free policy review or if you are making a claim for storm damage. You can learn more about our claim help here.

Common Mistakes to Avoid When Claiming for Storm Damage

- Failing to Report the Damage Promptly: Delaying your report of storm damage can weaken your claim. Insurers often require prompt notification.

- Overlooking Minor Damage That Could Worsen Over Time: Ignoring small issues like hairline cracks or slight leaks can be costly as they can worsen and insurers may refuse to cover them.

- Disposing of Damaged Items Before Documenting Them: Without evidence it is difficult to prove the extent of your losses.

- Misunderstanding Policy Terms and Exclusions: Always review your policy carefully to know what is and isn’t covered.

- Not Keeping Copies of All Correspondence with Your Insurer: Keeping a thorough record ensures you have proof of all interactions.

Steps to Take After Discovering Storm Damage

- Ensure Safety: Prioritize your safety and check for hazards

- Document the Damage: Capture detailed photographs and videos of the affected areas.

- Notify Your Insurer: Contact your insurance provider promptly.

- Prevent Further Damage: Make temporary repairs.

- Keep Receipts: Retain receipts for emergency repairs and temporary accommodation expenses.

How to Make an Insurance Claim for Storm Damage:

When filing a home insurance claim for storm damage, it’s essential to understand that the responsibility lies with you, as the insured, to demonstrate that the storm caused the damage to your property. This involves providing evidence such as photographs of the damage, weather reports confirming storm conditions, and, where necessary, expert assessments. Insurers are not obligated to disprove the cause of the damage; instead, they evaluate the evidence you provide to determine if it meets the criteria outlined in your policy.

To build a strong case for your claim, consider these points:

- Document the Damage Immediately: Once it’s safe, take clear photographs or videos of all affected areas.

- Obtain a Weather Report: Acquire a report or data verifying that a storm occurred in your area at the time of the damage.

- Engage a Professional Loss Assessor: A loss assessor can help you navigate the process, ensuring that your evidence is effectively presented.

- Retain Damaged Items: If feasible, keep damaged items as evidence until your insurer has inspected them.

- Act Quickly: Most insurance policies require prompt notification of a claim.

Storm Damage Insurance Claim Process

Here are some of the key steps to take to ensure a successful insurance claim:

- Notify Your Insurer Immediately: Promptly informing your insurer about storm damage is the first step in initiating your claim.

- Provide Comprehensive Evidence: Gather and submit evidence such as photos, videos, and receipts for repairs or damaged items.

- Complete Claim Forms Accurately: Filling out all required claim forms thoroughly and accurately is crucial to avoid delays or potential denials.

- Work with a Loss Assessor: Engaging a loss assessor can help ensure your claim is fairly represented.

- Maintain Regular Communication with Your Insurer: Staying in touch with your insurer throughout the process ensures you receive updates and guidance.

What if You Can’t Live in Your Home?

If your home is uninhabitable due to storm damage, most insurance policies include coverage for additional living expenses. This may include hotel stays, rental costs, or other temporary accommodations until repairs are completed. Check your policy for specific limits and conditions. Understanding this aspect of your coverage can ease the transition and provide peace of mind while you rebuild.

Frequently Asked Questions (FAQs)

What is a policy excess, and how does it affect my claim?

The excess is the amount you pay towards a claim. If the cost to repair is less than your excess, you cannot claim under your insurance policy.

Does my home insurance cover lightning strike damage?

Yes, most policies in Ireland cover damage caused by lightning strikes, but it is always good to double-check. A loss assessor can confirm if the damage was caused by lightning.

What if the damage was partially caused by existing wear and tear?

Insurance policies are not designed to repair wear and tear. So, the damage would need to be directly caused by the storm. You may only be able to claim for the parts of the damage that were directly caused by the storm, but it is a complex issue.

What are my rights if my claim is denied?

You have the right to appeal a claim denial and seek a review by the Financial Services and Pensions Ombudsman. It is recommended that you contact a loss assessor to help you.

Are there specific preparation steps insurers recommend before a storm?

Yes, insurers typically recommend securing loose outdoor items, clearing gutters, and checking your roof for loose tiles. Failure to properly maintain your property could result in a rejected claim.

Does my insurance cover flood damage?

In most cases, flood damage from rising groundwater or rivers is not covered by standard home insurance policies. You may need to purchase a dedicated flood insurance policy, especially if you live in a flood-prone area. However, flood damage directly resulting from a storm event (such as rainwater ingress) should be covered.

What if my roof was already old or damaged?

Insurance policies generally don’t cover pre-existing conditions or wear and tear. However, if the storm caused new and distinct damage to your roof, it may still be covered.

How long do I have to file a claim?

Most insurance policies have a time limit for filing claims, which can range from a few weeks to a few months. It’s crucial to act quickly. Check your policy details to confirm the timeframe.

Will my premiums increase after a claim?

Filing a claim can sometimes lead to an increase in your premiums, as insurers may view you as a higher risk. However, this depends on your insurer, the claim amount, and your claim history.

Do I need to hire a loss assessor?

Hiring a loss assessor can be beneficial, especially for significant or complex claims. They act on your behalf to ensure you receive a fair settlement.

What if I disagree with my insurer’s assessment?

If you believe your insurer’s assessment is unfair, you can request a second opinion or hire an independent expert to re-evaluate the damage. Additionally, you may escalate the issue through your insurer’s complaints process or seek mediation through an ombudsman service.

We hope this information is helpful. Remember, at Insurance Claim Solutions, we are here to support you.

Disclaimer: This content is for general informational purposes only and aims to provide an overview of storm damage claims. It does not constitute legal, financial, or insurance advice. For guidance tailored to your specific circumstances, please consult a claims professional or your insurance broker/provider.