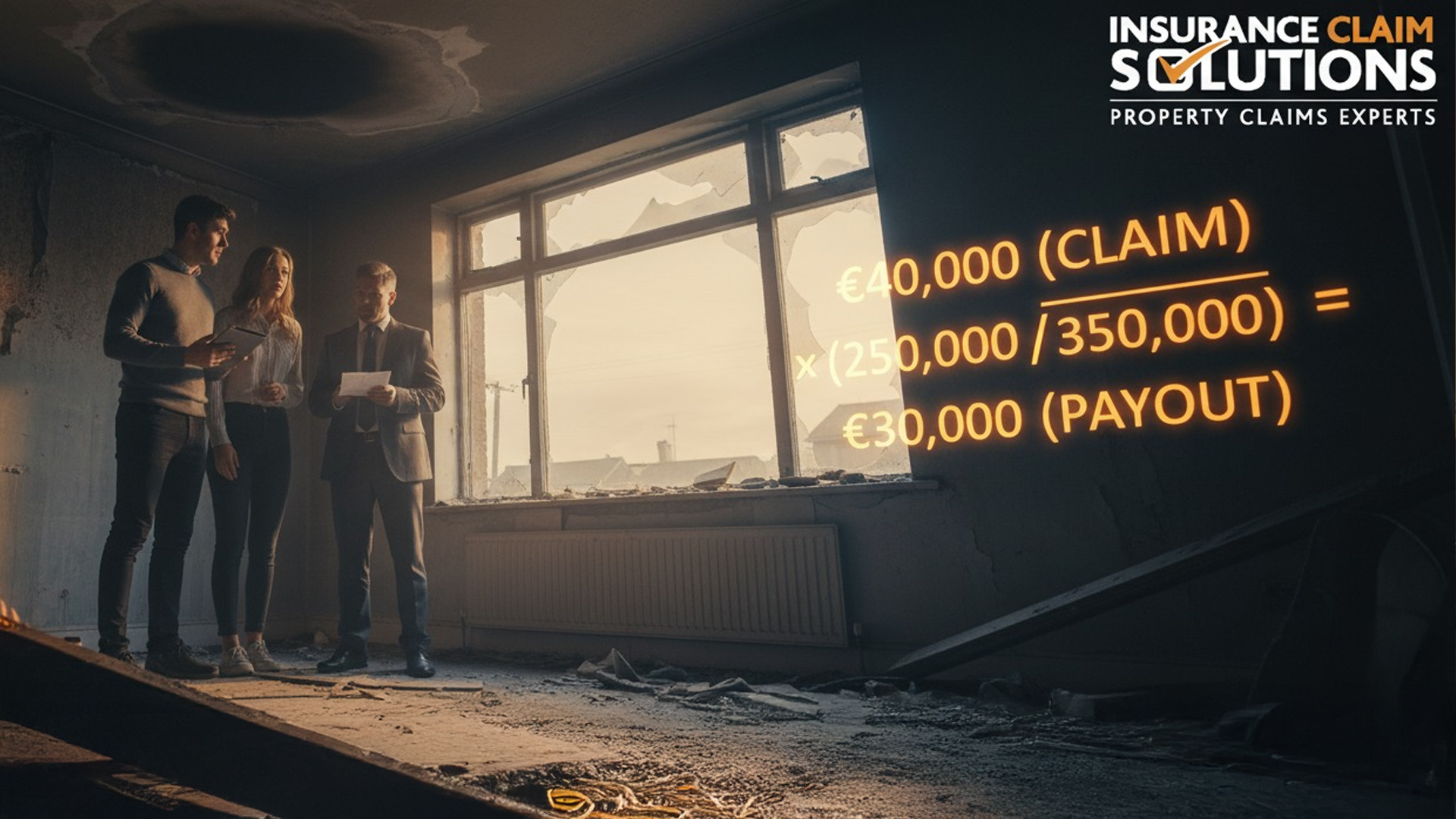

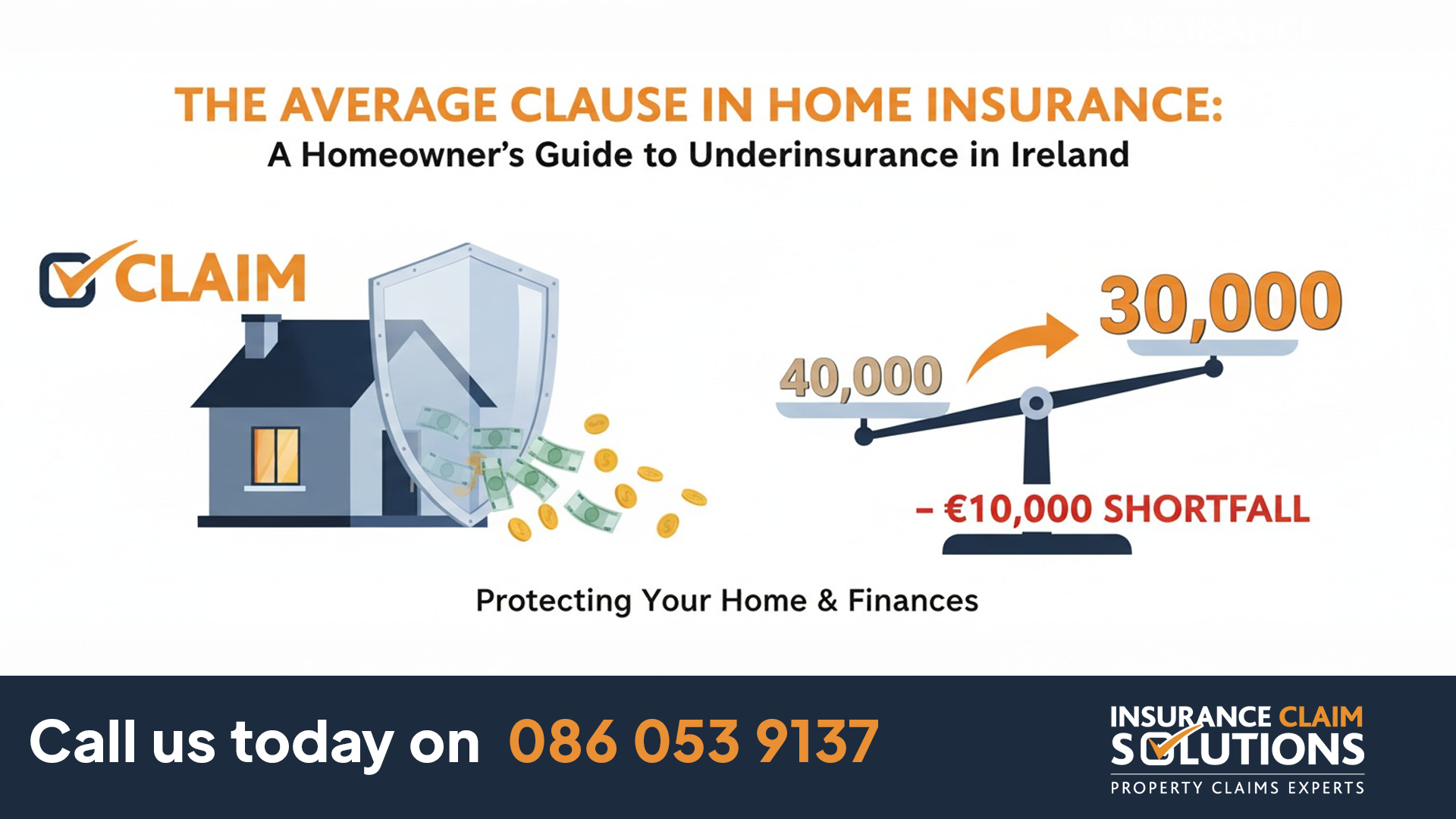

Your home suffers €40,000 worth of storm damage. You file a claim. Your insurer offers just €30,000.

Confused? Angry? You’re experiencing the Average Clause in action.

This single insurance provision costs Irish homeowners millions each year. Yet most discover it exists only after disaster strikes. When bills mount and stress peaks.

As Public Loss Assessors, we handle insurance claims daily. We see families caught out by underinsurance. Good people who thought they had full cover. Who paid premiums faithfully for years. Then found themselves thousands short when they needed help most.

Here’s the truth: understanding the Average Clause before you claim could save you from financial disaster.

What Exactly Is the Average Clause in Insurance?

The Average Clause is a standard provision in Irish home insurance policies. It reduces claim payouts when your property is underinsured.

Simple version? If you insure your home for less than its rebuild cost, every claim gets cut. Not just total loss claims. Every single one.

Think of it as a penalty for underinsurance. Your insurer calculates what percentage of proper cover you have. Then pays that percentage of any claim.

How Insurers Apply the Average Clause

Insurance companies don’t wait for total destruction to apply this clause. A burst pipe, causing €5,000 damage, triggers it. So does a small kitchen fire. Any claim, any size.

The process works systematically. You make a claim, your insurer checks your sum insured against current rebuild costs, they find you’re underinsured, they reduce your payout proportionally, and you pay the difference yourself. This happens automatically. No negotiation. No exceptions. It’s written into your policy terms.

Legal Framework & Consumer Rights in Ireland

Irish insurers operate within strict guidelines. The Central Bank requires transparency about the Average Clause. But transparency doesn’t mean protection.

Your policy documents spell out the clause clearly. Usually on page 47, in small print. Right where you’d expect crucial information to hide.

Consumer protection laws don’t override the Average Clause. Courts consistently uphold it when properly disclosed in policy documents. Because technically, you agreed to it when you bought the policy.

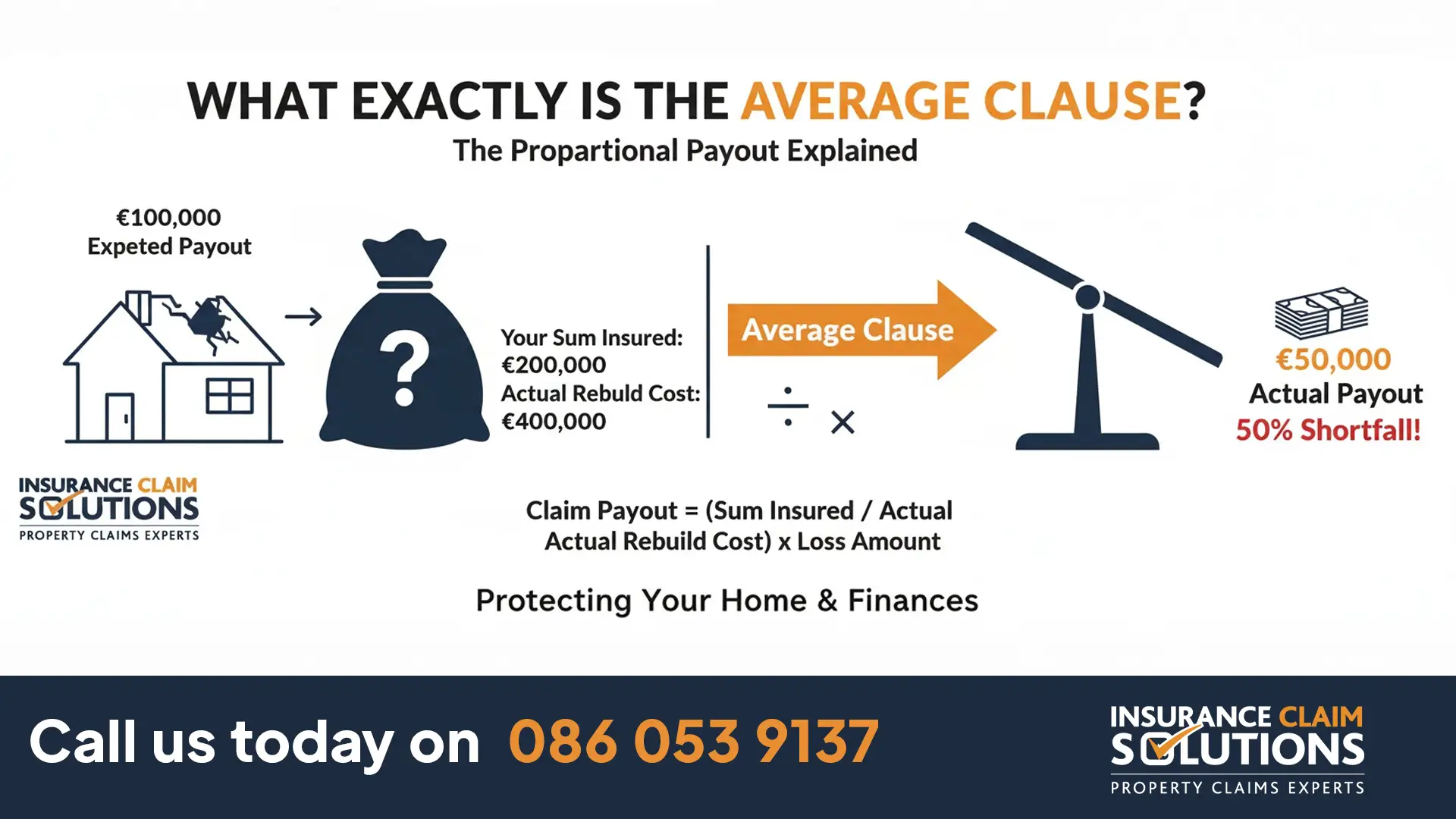

The Average Clause Formula: How Payouts Are Calculated

The Average Clause formula seems straightforward:

Let’s make this real.

| Claim Scenario | Your Cover | Actual Rebuild | Damage | You Receive | Your Shortfall |

|---|---|---|---|---|---|

| Storm Damage | €250,000 | €350,000 | €15,000 | €10,714 | €4,286 |

| Kitchen Fire | €300,000 | €400,000 | €60,000 | €45,000 | €15,000 |

| Total Loss | €350,000 | €500,000 | €500,000 | €350,000 | €150,000 |

That’s nearly 30% of repair costs from your pocket in the storm damage scenario. For being underinsured by an amount you probably didn’t know about.

Imagine explaining to your family why the kitchen can’t be fully repaired. Despite having “full” insurance. Or worse, losing your home entirely and discovering you can’t afford to rebuild it.

Why Irish Homeowners Fall Into the Underinsurance Trap

Property Values vs Rebuild Costs – The Confusion

Most people confuse market value with rebuild cost. Deadly mistake.

Your house might sell for €450,000. But rebuilding it could cost €380,000. Or €550,000. Market value includes land. Rebuild cost doesn’t. But rebuild cost includes demolition, site clearance, architect fees, VAT. Things market value ignores.

Dublin homeowners face particular challenges. A modest three-bed semi might sell for €500,000+. Its rebuild cost? Could be €280,000. Or €400,000 if period features need restoration. A period cottage in Dublin 4 might sell for €800,000 but cost only €400,000 to rebuild.

| What’s Included | Market Value | Rebuild Cost |

|---|---|---|

| Land Value | ✓ | ✗ |

| Location Premium | ✓ | ✗ |

| Demolition & Site Clearance | ✗ | ✓ |

| Professional Fees (10-15%) | ✗ | ✓ |

| VAT at 13.5% | ✗ | ✓ |

| Temporary Accommodation | ✗ | ✓ |

Inflation’s Silent Erosion

Building costs surged 14% in 2022 alone. Materials, labour, everything costs more now. Building costs have risen 30%+ since 2020.

That €300,000 sum insured from 2019? It buys maybe €240,000 worth of building work today. The Average Clause punishes you for inflation you couldn’t predict.

Home Improvements Nobody Tells Insurance About

New kitchen? Extension? Converted attic? Each increases rebuild costs.

We see it constantly. Homeowners spend €30,000 on renovations. Never update their insurance. Then wonder why claims fall short.

Every improvement needs a policy review. That €15,000 bathroom renovation might add €20,000 to rebuild costs. Quality fixtures cost more to replace than install.

Real Stories From Our Claim Files

Case 1: The Cork Flood

Details altered for privacy

Margaret’s Cork home flooded in November 2023. Water destroyed floors, walls, electrics. Damage assessment: €75,000.

Her sum insured: €200,000. Actual rebuild cost: €320,000.

Average Clause reduced her payout to €46,875. She borrowed €28,125 to complete repairs. Still paying it back.

“I thought I was fully covered. I’d paid insurance for 22 years. Never claimed before. Then when I needed it…”

Case 2: Dublin Fire Damage Claim

Young couple. First home. An electrical fire in February 2024 caused €40,000 damage.

Sum insured: €250,000 (estate agent’s recommendation from 2021). Current rebuild cost: €340,000.

Payout after Average Clause: €29,412. Shortfall: €10,588.

They moved back in with their parents for eight months. Saved every cent for repairs. Marriage under strain. All are preventable with proper coverage.

Case 3: Storm Damage Success Story

This one ends differently.

Tom reviewed his insurance after reading about underinsurance. Increased cover from €280,000 to €380,000. Premium rose €127 yearly.

Storm damaged his roof three months later. €22,000 claim paid in full. No Average Clause applied. Because he’d insured properly.

“Best €127 I ever spent.”

Tools & Resources to Avoid the Average Clause

| Protection Step | What To Do | Cost/Frequency |

|---|---|---|

| Calculate Actual Rebuild Cost | Use SCSI calculator. Factor in current construction costs per square metre, total floor area, demolition, professional fees (10-15%), VAT at 13.5%, temporary accommodation, and special features. | Free online / Annual review |

| Professional Assessment | A Chartered Quantity Surveyor measures everything, assesses quality, considers access, and factors local costs. Our rebuild cost assessment service, via RebuildValuation.ie, specialises in this. | €300-€500 / Every 3-5 years |

| Index-Link Your Policy | Automatically adjusts the sum insured annually to track construction inflation. Check your policy includes it, but note it may not keep pace with rapid inflation spikes. | Usually included / Automatic |

| Review After Changes | Update your policy after kitchen extensions, garden offices, solar panels, or significant market jumps. Set phone reminders. | Free / After any improvement |

| Document Everything | Photograph your property regularly. Keep renovation receipts, building certs, planning permissions, and engineer reports. Use our insurance claim checklist as a guide. | Free / Ongoing |

Warning Signs You’re Already Underinsured

Your Premium Seems Suspiciously Low: Comparing premiums with neighbours? Yours significantly lower? Red flag. Insurance premiums reflect risk AND value. Underinsured properties generate lower premiums but lead to inadequate payouts.

You Haven’t Updated Cover in Three Years: Building costs rose 30%+ since 2020. If your sum insured hasn’t, you’re likely underinsured. Even index-linking might not keep pace with recent inflation. Manual review is essential.

Using Original Purchase Price Plus Inflation: Bought in 2010 for €200,000? Adding general inflation gives maybe €250,000 today. But the actual rebuild cost could be €350,000. Property purchase prices and rebuild costs follow different trajectories.

Estate Agent Valuations as Basis: Estate agents estimate market value, not rebuild costs. This is a different expertise and yields different figures. We’ve seen €100,000+ gaps between estate agent valuations and professional rebuild assessments on the same property.

Common Misconceptions That Cost Homeowners

| The Myth | The Reality |

|---|---|

| “The Insurer Will Pay What It Costs” | They pay what you’re covered for, reduced by the Average Clause if underinsured. Insurance isn’t a blank cheque; it’s a contract with specific limits. |

| “Market Value Equals Rebuild Cost” | Never true. Market value includes the location premium. Rebuild cost includes construction complexity and associated fees. |

| “I Only Need to Insure for My Outstanding Mortgage” | Your mortgage decreases over time while rebuild costs increase. This strategy guarantees underinsurance within years. Banks protect their loan, not your home. |

| “Small Claims Won’t Trigger Average Clause” | Every claim triggers an assessment. A small insurance claim faces the same proportional reduction as a €50,000 claim if you are underinsured. |

Frequently Asked Questions about the Average Clause

Q: How often should I review my rebuild cost?

Annually at a minimum. After any improvements, do it immediately. When construction costs spike, don’t wait for renewal. Use any free rebuild cost reviews offered by your insurer.

Q: Can I challenge the Average Clause application?

Challenging it requires proving the insurer’s rebuild cost assessment is wrong, which is difficult without professional evidence from a loss assessor. A better strategy is ensuring adequate coverage beforehand. Prevention beats litigation every time.

Q: Does the Average Clause apply to contents insurance too?

Yes, if your contents are underinsured, the same proportional reduction applies. Regularly value your possessions. A five-year-old TV isn’t worth its purchase price, but antique furniture might be worth more than you think.

Q: What if rebuilding standards have changed?

Modern building regulations often require upgrades during a rebuild (e.g., better insulation, accessibility, energy efficiency). These add costs and must be factored into your rebuild calculations. Your 1960s bungalow won’t be rebuilt to 1960s standards.

Q: Will my insurer warn me about underinsurance?

Insurers must explain that the Average Clause exists. They are not required to assess if *you* are underinsured. That responsibility is yours. Harsh, but legal.

Q: Is the Average Clause legal?

Completely legal in Ireland. Courts consistently uphold it when it’s properly disclosed in policy documents. Consumer protection does not override contractual agreements you have signed.

Q: Do all insurers apply the Average Clause?

Most do. Some policies waive it if underinsurance is below a certain threshold (e.g., 15-20%), but these policies typically cost more. Read your documents and ask your provider explicitly. Never assume.

Take Action Today – Before It’s Too Late

The Average Clause isn’t going away. But its impact on you can be neutralised.

Review your coverage this week. Not next month. Not at renewal. This week.

Calculate your rebuild cost properly. Get a professional assessment if needed. Update your sum insured. Pay the extra premium.

Because discovering underinsurance after tragedy strikes breaks more than bank accounts. It breaks families. It shatters trust and peace of mind.

We see it too often. Don’t become another cautionary tale.

Expert Guidance from Regulated Professionals

This guide is based on decades of combined experience from our team of dedicated loss assessors. We are Insurance Claim Solutions (Trevor Kelly Insurance Claim Solutions Ltd), regulated by the Central Bank of Ireland (Reg No. C423441) and committed to defending the interests of homeowners.

Trevor Kelly — Managing Director

BSc (Hons) Building Surveying, Registered Public Loss Assessor

Led by Trevor, our team includes senior building surveyors like John Holland and dedicated claims staff, all working to secure the best possible outcome for your claim.

We Negotiate With Insurance Companies So You Don’t Have To

Already facing claim issues? Worried about underinsurance? Our team of Dublin-based expert loss assessors will guide you through the complexities and ensure you receive the full settlement you deserve.

Free claim review. No obligation.

Available 24/7 for emergencies. Call us on: 086 053 9137

Disclaimer: This article provides general information about insurance claims and the Average Clause in Ireland. Individual circumstances vary. Always consult qualified professionals for advice specific to your situation. Information accurate as of September 2025.

“`