The Claim Process: 6 steps to your full settlement

Imagine arriving at your shop in Santry or your office in Cork to find a burst pipe has ruined everything. Your head starts spinning while you look at the soaked carpets and soggy files. The claim process starts the very second you discover that damage. Most people think their insurance company will simply “make it […]

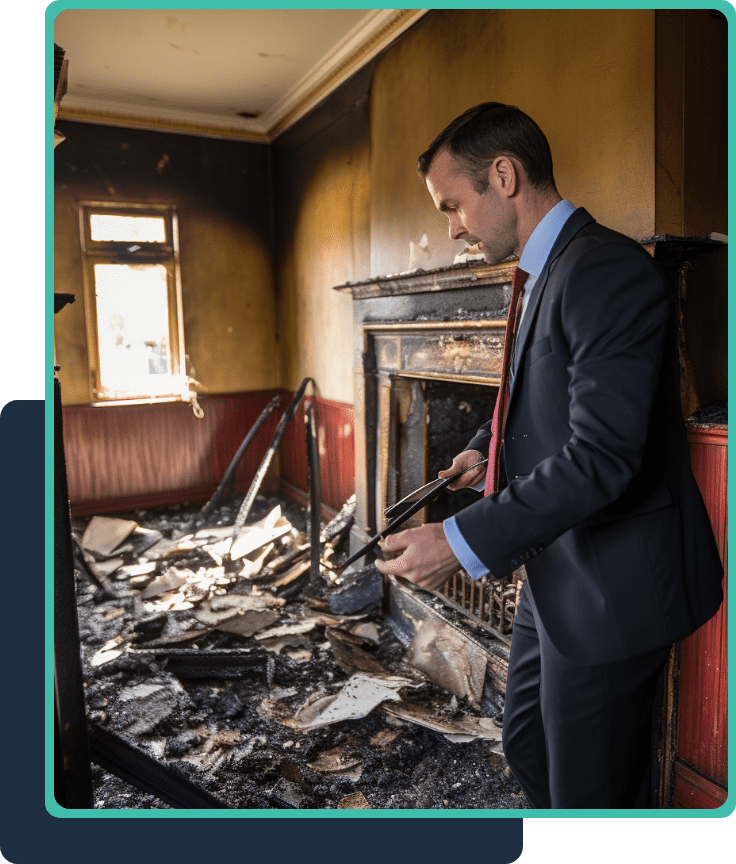

How Loss Assessors Help With Insurance Claims

How Do Loss Assessors Help With Insurance Claims? When you suffer a loss and need to file an insurance claim, the process can be complex and overwhelming. This is where loss assessors come in – they act as your advocate throughout the claim process. How do loss assessors help with insurance claims? Let’s explore their […]

What is an Insured Peril? | Homeowner Advice Guide

When you purchase insurance coverage for your home, business, or other property, the policy outlines specific events or causes of damage that are covered. These events are known as “insured perils.” Understanding insured perils is crucial because they determine whether your insurance provider will compensate you for any losses or damages incurred. So what is […]

Can I Claim on Insurance for Water Damage?

Water damage can be one of the most costly and disruptive events a homeowner or business owner can face. From burst pipes to flooding, excess moisture can ruin floors, walls, furniture, and personal belongings in a matter of hours. The big question is whether your insurance policy will cover the resulting damage and repair costs. […]

What is an Insurance Assessor?

What is an insurance assessor? An insurance assessor, also known as a loss assessor, is a professional who specialises in evaluating and assessing insurance claims. They play a crucial role in ensuring that policyholders receive fair and accurate settlements from insurance companies. When your property is damaged, whether by a fire, a flood, or a […]

How to Deal with an Insurance Adjuster After Water Damage

If your property has suffered water damage, you’ll need to know how to deal with an Insurance Adjuster After Water Damage. First and Foremost you will need to file an insurance claim and work with an adjuster to settle it. Navigating this process effectively requires understanding key steps, being prepared with documentation, and asking the […]

Are Loss Adjusters Regulated in Ireland?

When filing an insurance claim, policyholders in Ireland may interact with a loss adjuster, in this article we will look at “are loss adjusters regulated in Ireland?”. Loss adjusters are independent claims specialists who investigate claims on behalf of insurance companies. They assess the damage or loss, determine how much the insurance company should pay […]

Why do insurers appoint Loss Adjusters?

A loss adjuster is an independent claims specialist appointed by insurance companies to investigate and assess insurance claims. They play a key role in the claims process by conducting a thorough assessment of damages and losses to determine fair settlement amounts. This article will explain what loss adjusters do, why insurers use them and provide […]

What does a loss adjuster do? | Ultimate Guide 2024

One of the most commonly asked questions we encounter is What does a loss adjuster do? The answer is simple, When you make an insurance claim, the insurance company will often appoint a loss adjuster to investigate the details of your claim. Loss adjusters are claims specialists who determine the cause and extent of damage […]

Who pays for a loss assessor? | Total Guide | ICS

One of the most frequently asked questions we hear is “Who pays for a loss assessor?”. Unlike an insurance adjuster, a loss assessor is paid by the claimant, the fees will invariably be taken as a % of the overall and eventual payout from the subsequent successful claim. Although they serve a somewhat similar purpose […]