- Open 24/7 365

Insurance Claims Management is not as straight forward as you might think. Many people think that all they have to do is to call their insurance company and that the insurance company will list everything they could claim for and send them the cheque.

Unfortunately, it does not work quite this way. The insurance company is very unlikely to pay out more than you ask for; just the opposite. Unless you are using an experienced claim manager to handle your claim, they are most likely to pay you less.

We offer end-to-end insurance claims management. That includes assessing the loss, interpreting the small print in your insurance policy, and negotiating the best possible settlement of your claim.

Insurance Claim Solutions offer comprehensive insurance claims management services covering all stages of the claim management process

If you have ever dealt with an insurance company in the past, you are probably aware that insurance companies rarely live up to their advertising statements. In order to make a profit, they have to minimise their losses. Your claim is their loss.

After you file a claim, your insurance company appoints a legal expert to scrutinise the small print in your insurance policy and see if any exclusions can be applied to decline or reduce your claim.

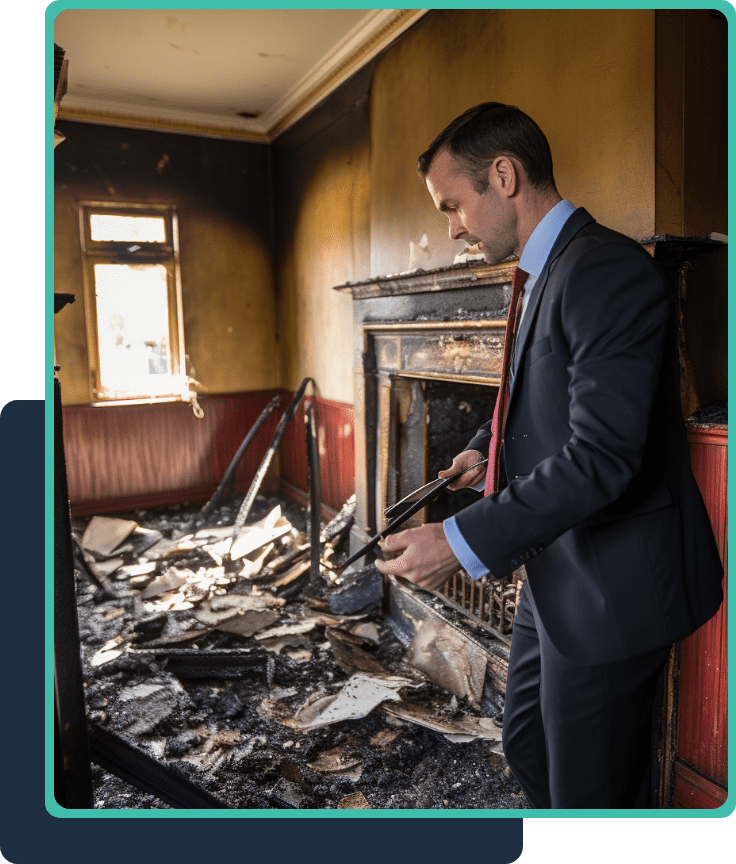

They also send out a company Loss Adjuster to assess the damage. The Loss Adjuster is not on your side. His role is to minimise the losses to the insurer. So he often omits the damages that are not immediately obvious and you are none the wiser until you receive the final settlement figure and compare it to the actual repair bill.

Some damages, such as water ingress or smoke damage, can manifest themselves long after the claim is settled and closed. Unfortunately, if they are not included in your claim right at the beginning, you will have to foot the repair bill yourself.

Delay in settling the claim is another common tactic used by insurance companies. They know that the longer you wait for the settlement, the more desperate you become. And the more desperate you are, the more likely you are to accept a lower settlement figure, just to get your life back to normal.

It is therefore always better to appoint a claim manager, who is going to make sure that your claim is dealt with promptly and fairly. Someone who knows the game and protects your interest.

If you need help with managing your insurance claim, call Trevor Kelly on 086 357 1713 for FREE initial consultation and advice..

Insurance Claims Management Services

Insurance Claim Solutions offer comprehensive insurance claims management services covering all stages of the claim management process:

Insurance Claim Solutions have many years of experience in dealing with all types of insurance claims – fire damage, storm, burst pipe, flood, subsidence, burglary, or malicious damage to property.

Over the past decade, we have helped thousands of home and business owners in Ireland and Northern Ireland, manage their insurance claims and receive full compensation for their losses.

Our very high success rate speaks for itself, read our testimonials and see for yourself. Most of our business comes from recommendations of previous clients, so you can rest assured that your claim will be in good hands.

We represent you, the Policy holder, not the insurance company and work exclusively on a NO WIN – NO FEE basis. This means that there is no risk to you and there is no payment required until you receive your cheque.

Registered Public Loss Assessor, regulated by the Central Bank of Ireland

Don’t let the stress of dealing with insurers and repair contractors overwhelm you. Contact us today, and let us handle your insurance claim while you focus on your recovery.

Website By Bubblehub Media