Welcome to your comprehensive guide to subsidence damage and home insurance claims in Ireland. We understand that discovering subsidence in your home can be unsettling. This guide provides clear, accurate information to help you navigate the complexities of subsidence, from identifying the initial signs to successfully managing your insurance claim. Our aim is to empower you with the knowledge you need to protect your property and your peace of mind.

Understanding Subsidence Damage

What is subsidence?

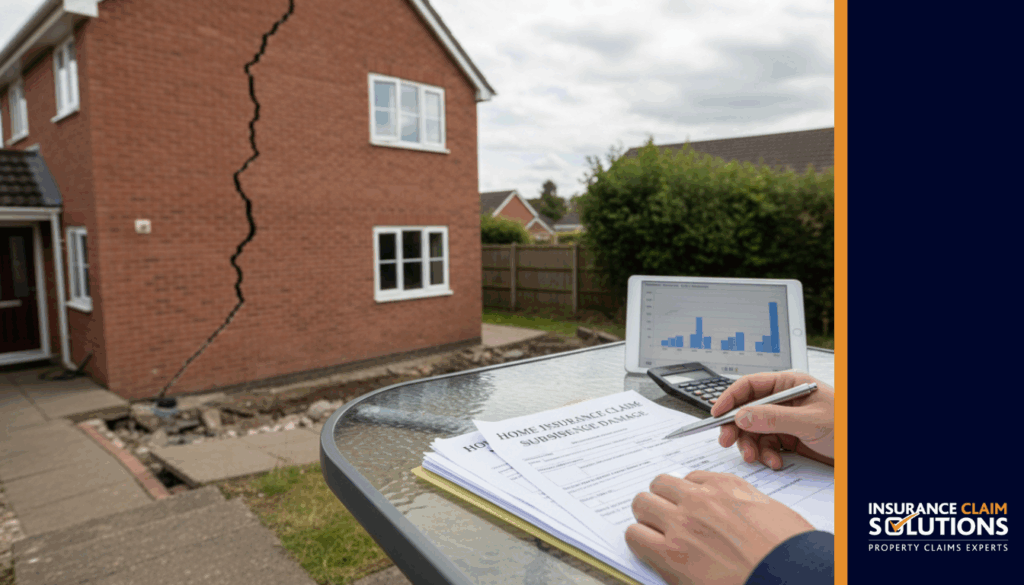

Subsidence refers to the downward movement of the ground beneath a property’s foundation. This movement can cause structural damage, leading to cracks in walls and other visible problems. It’s essential to understand that subsidence differs from normal settlement, which occurs naturally as a building ages. Settlement typically causes minor, hairline cracks that stabilise over time. Subsidence involves ongoing ground movement that can lead to significant structural issues if left unaddressed.

Common signs of subsidence damage

Identifying the early signs of subsidence is crucial for preventing more serious structural problems. Several indicators can help you spot potential issues before they become major concerns.

Key warning signs include:

- New cracks appearing in walls, especially those wider than 3mm (about the thickness of a €1 coin)

- Diagonal cracks that are wider at the top than at the bottom, typically around doors and windows

- Doors and windows that suddenly become difficult to open or close

- Gaps appearing between walls and ceilings or between walls and floors

The most telling sign is diagonal cracks that run at roughly 45-degree angles, typically found around door frames and window openings. These cracks are usually wider at the top than at the bottom, following the direction of the ground movement beneath. Other visual cues include leaning or bulging walls, floors that slope noticeably, and distortions in the building’s overall structure.

If you observe these signs, it’s time to investigate the potential causes and consider consulting a professional. Early intervention can prevent minor subsidence from developing into a major structural problem requiring extensive repairs.

Causes of Subsidence in Irish Properties

Natural causes

Clay soil is the primary natural cause of subsidence in Ireland, particularly in counties like Dublin, Cork, and Meath where clay-rich soil is widespread. Clay expands when wet and contracts when dry, creating a cycle of movement that can destabilise foundations over time. During prolonged dry periods, clay soil shrinks as moisture evaporates, causing the ground beneath your home to sink.

Tree roots are another significant natural cause. Large trees near your property draw substantial amounts of moisture from the soil, especially during dry spells. This moisture extraction causes the surrounding soil to shrink, potentially leading to subsidence. Mature trees like oak, willow, poplar, and elm are particularly thirsty and can affect soil up to a distance equal to their full height from your property.

Human-induced causes

Leaking drains are one of the most common human-induced causes of subsidence. When drainage pipes crack or joints fail, water escapes and gradually washes away the soil supporting your foundation. This erosion creates voids beneath the building, leading to subsidence as the ground can no longer support the structure’s weight.

Nearby construction work can also trigger subsidence. Excavations for new buildings, road works, or utility installations can disturb the ground and affect neighbouring properties. Heavy machinery and pile driving create vibrations that can compact or shift soil, whilst deep excavations can alter groundwater levels and drainage patterns.

Making a Claim for Subsidence Damage

The subsidence insurance claims process

Start by reporting the signs of subsidence to your insurer as soon as you suspect a problem. Most policies require prompt notification, and delays can give insurers grounds to question your claim. When you make initial contact, provide your policy number and a factual description of what you’ve observed, including when you first noticed the problem.

Your insurer will then appoint a loss adjuster to investigate the claim. The loss adjuster works for the insurance company and will visit your property to assess the damage. They’ll examine the cracks, review the property’s history, and may commission additional reports from structural engineers or drainage specialists.

This investigation phase can take several months. The insurer needs to establish that genuine subsidence has occurred, identify the cause, and determine whether it falls within your policy coverage. Once the investigation is complete and the claim is accepted, the insurer will discuss repair options and costs.

Documentation needed for your insurance claim

Thorough documentation significantly strengthens your subsidence claim and helps prevent disputes with your insurer. Start gathering evidence as soon as you notice potential problems.

Essential documentation includes:

- Detailed photographs of all cracks, taken from multiple angles and with measurements for scale

- Written notes about when you first noticed each crack and whether they’ve grown

- Any previous surveys or structural reports for the property

- Records of recent drainage work or nearby construction activity

Keep copies of all correspondence with your insurer, including emails, letters, and notes from phone conversations. Record the date, time, and name of anyone you speak with, along with a summary of what was discussed.

Working with a loss assessor

Engaging a professional loss assessor can be beneficial when navigating a complex subsidence insurance claim. Unlike the loss adjuster appointed by your insurance company, a loss assessor works exclusively for you, representing your interests throughout the claims process.

A loss assessor brings specialist knowledge of subsidence claims, understanding both the technical aspects of structural damage and the intricacies of insurance policies. They handle all communication with your insurance company, relieving you of this stressful burden. They negotiate on your behalf, working to help ensure all eligible damage is properly documented and that proposed repair solutions are appropriate for your property.

Home Insurance and Subsidence Claims

Understanding your home insurance policy

Most standard Irish home insurance policies include subsidence coverage, but there are important variations. Review your policy documents carefully to understand exactly what’s covered. Look for the specific definition of subsidence used in your policy, as some insurers define it narrowly to exclude certain types of ground movement.

Pay particular attention to policy exclusions. Many policies exclude subsidence caused by coastal erosion, mining activity, or defective construction. Check your policy excess for subsidence claims, which is typically higher than for other types of damage, often ranging from €1,000 to €5,000 or more.

What to expect from your subsidence insurance claim

When you make a subsidence insurance claim, expect a thorough and often lengthy investigation. Insurers take subsidence claims seriously because repair costs can be substantial, sometimes reaching tens of thousands of euro.

The investigation typically begins with a site visit from the insurer’s loss adjuster, followed by a structural engineer’s report. Many insurers then require a monitoring period, typically lasting 6-12 months, to track whether the movement is ongoing or has stabilised. Be prepared for the entire process to take 12-18 months or longer from initial report to completion of repairs.

Repairing and Preventing Subsidence

Fixing subsidence: underpinning and other methods

Underpinning is the most common repair method. This involves strengthening the foundation by excavating beneath it in sections and extending it deeper into more stable ground. Traditional mass concrete underpinning creates a new, deeper foundation that reaches soil layers unaffected by moisture changes. Whilst effective, underpinning is expensive and time-consuming, typically costing €20,000-€50,000 or more.

Resin injection offers a less invasive alternative in some cases. This involves injecting expanding resin into the soil beneath the foundation, which fills voids and compacts loose soil. Addressing the root cause is often sufficient to stop subsidence without extensive foundation work. If a leaking drain caused the problem, repairing the drain may be all that’s needed.

Preventing future subsidence issues

Maintain your drainage systems properly. Have your drains inspected regularly and address any leaks immediately. Keep gutters and downpipes clear and in good condition, ensuring rainwater is directed away from the building.

Be thoughtful about trees near your property. As a general rule, don’t plant large trees closer to your building than their mature height. Monitor your property regularly for early warning signs, particularly after prolonged dry spells or heavy rain.

The Impact of Subsidence on Property and Insurance

How subsidence affects property value

A property currently experiencing subsidence will see a substantial reduction in market value. Many lenders refuse to provide mortgages for properties with active subsidence, effectively limiting your pool of potential buyers to cash purchasers only. Even after successful repairs, a history of subsidence affects value, though properties typically sell for 5-10% less than comparable properties without this issue.

Understanding insurance implications

Making a subsidence claim will almost certainly increase your future insurance premiums. Insurers view properties with subsidence history as higher risk, and expect premium increases of 20-50% or more when your policy renews. These higher premiums typically continue for at least five years. Some insurers may refuse to offer renewal coverage at all after a subsidence claim.

Getting Professional Help with Subsidence Claims

At Insurance Claim Solutions, we specialise in helping Irish homeowners and businesses dealing with subsidence claims throughout Ireland. Based in Dublin and working nationwide, we understand the complexities of subsidence claims and the specific challenges they present in the Irish market.

Our team of accredited loss assessors and chartered surveyors brings extensive experience managing subsidence claims from initial assessment through to completion of repairs. We take over the entire claims process, handling all communication with your insurer and negotiating on your behalf to work toward appropriate settlements.

If you’re concerned about subsidence in your property or need help with an existing claim, contact us for a free consultation. Call 086 053 9137 or email info@insuranceclaimsolutions.ie.

Key Takeaways About Subsidence

Subsidence is serious, but understanding it helps you respond effectively. Watch for diagonal cracks wider than 3mm, doors and windows that stick, and any gaps appearing around your foundation. If you spot these signs, act quickly.

Your insurance policy most likely covers subsidence, but coverage details vary significantly between insurers. Read your policy carefully, understand your excess, and know what’s excluded. The claims process for subsidence is lengthy, typically taking 12-18 months from initial report to completion of repairs.

Prevention is always better than cure. Maintain your drainage systems, be thoughtful about trees near your property, and monitor regularly for early warning signs. If you’re dealing with subsidence, professional help is available.

Dealing with subsidence damage? Insurance Claim Solutions provides expert subsidence claim management throughout Ireland. Contact us at 086 053 9137 or email info@insuranceclaimsolutions.ie.

Need Help with Your Insurance Claim?

Expert loss assessors working exclusively for you

Contact Insurance Claim Solutions Today!

No Win – No Fee Basis

We work exclusively for you, not the insurance company

Regulated by the Central Bank of Ireland